Roving Periscope: If IMF doesn’t bail it out, Pak may go Sri Lanka’s way in June

Virendra Pandit

New Delhi: Come June, Pakistan may also join Sri Lanka as its economic crisis and political instability deepen, pushing the bankrupt and terror-infested South Asian country into the dustbin of failing states.

Already, Pakistan is a global pariah, afflicted with soaring inflation, squabbles over surging fuel prices, and a deeply divided political environment. For a long time, it has been struggling to keep its hand-to-mouth economy afloat as its attempts to get fresh loans or have the old ones restructured have failed.

Even its traditional benefactors—China, the UAE, and Saudi Arabia—no longer help it. Global investors are nervous their money might sink in one of the most populous countries, with a population of over 220 million.

Pakistan’s external debt amounted to USD 130.6 billion in December 2021, which was about 70 percent of its GDP. That meant debt-servicing alone consumed over three-fourths of Pakistan’s annual revenue.

Currently, Islamabad is facing a wave of potential global defaults, which may push it into an unprecedented economic and political crisis, the media reported on Wednesday.

Without a bailout from the International Monetary Fund (IMF), Pakistan may now default for the second time in its history. As talks with the IMF conclude on Wednesday in Doha, officials acknowledge that winning a loan from the multilateral lender might involve trade-offs, including the politically tough decision of raising fuel prices.

“We are confident we’ll get to the finish line,” Murtaza Syed, acting governor of the State Bank of Pakistan, said on Tuesday, according to reports.

Pakistan’s nervous negotiations with the IMF came when its people are battling Asia’s second-fastest inflation and ousted Prime Minister Imran Khan threatened to march to the national capital with his supporters to force early elections. With a barrage of financial shocks caused by the pandemic, Russia’s war in Ukraine, and rising interest rates, Pakistan is among the emerging economies facing debt restructuring.

Pakistan is seeking a fresh USD 3 billion loans from the IMF to augment the nation’s plummeting foreign-exchange reserves, which at just USD 10.2 billion, cover less than two months of imports. The government is staring at a USD 45 billion trade deficit this year while the value of the Pakistani rupee has dropped to over 200 per US dollar.

A sticking point for the IMF relates to Khan’s tenure, which ended in April. Before leaving office, he reduced fuel and gasoline prices and then froze them for four months, a last-ditch attempt to improve his image among voters and quell frustration over rising costs.

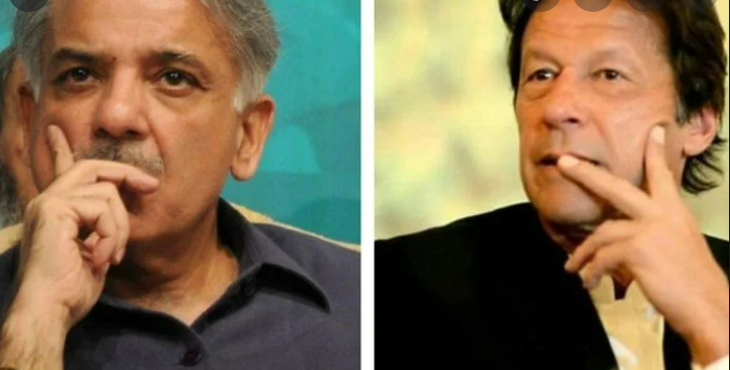

But the IMF has delayed giving Pakistan more money until the government scraps the fuel subsidies. And Khan’s successor, Shehbaz Sharif, has deferred raising prices despite the subsidies costing USD 600 million a month. The government has resisted angering a population already struggling to afford staples like wheat and sugar.

Relentless political fighting between the Shehbaz Sharif-led coalition government and Imran Khan has complicated a path forward with the IMF. In recent weeks, Khan’s party, Pakistan Tahreek-e-Insaf (PTI), pushed for mid-term elections a year before planned in a bid to recapture power.

With Imran Khan threatening to bring Islamabad to a standstill, the city is bracing for unrest. Police barricaded the capital’s Red Zone, which houses key government buildings, including Parliament, embassies, and the PM’s offices. The government said it will not allow demonstrations, raising concerns that more mayhem and social unrest could follow.