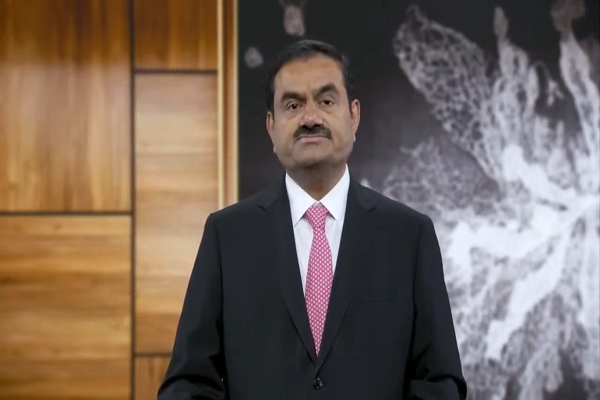

I anticipate that within the next decade, India will start adding a trillion dollars to its GDP every 18 months: Gautam Adani

Adani Group Chairman Gautam Adami said at the Annual General Meeting, When I founded the Adani Group over three decades back, I had never have imagined that the Adani Group would grow to become one of the largest conglomerates of the country. It was on the 12th of September 1994 that Adani Enterprises, then known as Adani Exports, launched its IPO.

I had just turned 32.

Today, as I reflect over the past years, I am grateful to so many, who have enabled your company to come this far. While our true ambitions still lie ahead of us – when we make time to look back – we also realize how much ground we have covered over the past 30 years. Along this journey, if there is one characteristic that has continued to define us – it has been our resilience.

• The resilience that allows us to get up stronger every time we take a hit.

• The resilience that drives our belief in the nation we call our matrubhumi.

• And the resilience that gives us the passion to follow our dreams.

And I will touch upon each of these today.

As all of you are aware, on the eve of our Republic Day this year, a US-based short- seller published a report to short our stocks just as we were planning to launch the largest Follow-on Public Offering in India’s history.

The report was a combination of targeted misinformation and discredited allegations, the majority of them dating from 2004 to 2015. They were all settled by the appropriate authorities at that time. This report was a deliberate and malicious attempt aimed at damaging our reputation and generating profits through a short-term drive-down of our stock prices.

Subsequently, despite a fully subscribed FPO, we decided to withdraw and return the money to our investors to protect their interests. While we promptly issued a comprehensive rebuttal, various vested interests tried to exploit the claims made by the short seller. These entities encouraged and promoted false narratives across various news and social media platforms.

Consequently, the Hon’ble Supreme Court of India constituted an Expert Committee to look into this matter. The committee included individuals known for their independence and integrity. The report of the Expert Committee was made public in May 2023.

The Expert Committee did not find any regulatory failure. The Committee’s Report not only observed that the mitigating measures, undertaken by your company helped rebuild confidence but also cited that there were credible charges of targeted destabilization of the Indian markets. It also confirmed the quality of our Group’s disclosures and found no instance of any breach.

While SEBI is still to submit its report, we remain confident of our governance and disclosure standards. It is my commitment that we will continue to strive to keep improving these, every single day.

Our track record speaks for itself, and I am grateful for the support our stakeholders have shown as we went through our challenges. It is worth noting that even during this crisis – not only did we raise several billions from international investors – but also that – no credit agency – in India or abroad – cut any of our ratings.

This is the strongest validation of the belief that the investors have in your company’s governance and capital allocation practices.

Over the past decade – one statement that I have repeated dozens of times – is my belief in the future of the nation we call our matrubhumi. Let me try and set some context.

Today, there can be no denying that the world is continuing to be hit by multiple shocks, be it the climate emergency, geopolitical challenges, supply chain and energy volatility, or persistent inflation. We have never had a time when such events were happening simultaneously without a clear solution in sight.

Add to this the opportunities and challenges because of the technological revolution, especially the breath-taking advances in artificial intelligence, and what we have is a massive potential reset in the existing global operating models.

The future of work, the future of learning, the future of medicine, and in some ways, the future of economic growth itself will need to be reset. Therefore, as we end one financial year and begin another, it is important to take a step back and assess the global situation and India’s position as part of this landscape.

While economic cycles are getting increasingly hard to forecast, there is little doubt that, India – already the world’s 5th largest economy – will become the world’s 3rd largest economy well before 2030 and, thereafter, the world’s 2nd largest economy by 2050.

It is well understood that for any economy to implement policy and lay the foundation of growth, a stable Government is critical, and we have seen this impact with the implementation of several structural reforms that are critical for strong, sustainable, and balanced growth. This stability, coupled with India’s demographics and continued expansion of internal demand, is a potent combination.

Our nation’s demographic dividend is expected to drive consumption and accelerate the growth of a tax paying society at record pace. The United Nation’s Population Fund projects that India’s median age will be just 38 years even in 2050.

Over this period, India’s population is expected to grow by approximately 15% to 1.6 billion, but the per capita income will accelerate by over 700% to about 16,000 US dollars. On a purchasing power parity basis, this per capita metric will be 3 to 4 times higher.

And we have the statistics to prove it. Following our independence, it took us 58 years to get to our first trillion dollars of GDP, 12 years to get to the next trillion and just 5 years for the third trillion. I anticipate that within the next decade, India will start adding a trillion dollars to its GDP every 18 months.

This puts us on track to be a 25 to 30 trillion-dollar economy by 2050 and will drive India’s stock market capitalization to over 40 trillion dollars – approximately a10X expansion from current levels.

I would urge you to reflect on these incredible possibilities. India’s success story of balancing economic growth and a vibrant democratic society has no parallel.

My belief in the growth story of our matrubhumi has never been stronger. And now let me talk about our results:

Our FY22-23 operational and financial results are as much a testimony to our success as testimony to the continued expansion of our customer base – be it on the B2B side or the B2C side.

Our balance sheet, our assets, and our operating cashflows continue to get stronger and are now healthier than ever before. The pace at which we have made acquisitions and turned them around is unmatched across the national landscape and has fuelled a significant part of our expansion.

Our national and international partnerships are proof of our governance standards. The scale of our international expansions is validated by our success in Australia, Israel, Bangladesh, and Sri Lanka.

Some of our key achievements are as follows:

The Adani Group of companies set new financial performance records for FY 22-23.

- Total EBITDA grew by 36% to Rs 57,219 crore,

- Total income grew by 85% to Rs 2,62,499 crore, and

- Total PAT grew by 82% to Rs 23,509 crore.

The Group’s accelerating cashflow further improved our net Debt to run rate EBIDTA ratio from 3.2x to 2.8x.

Our flagship company, Adani Enterprises Limited, continued to successfully demonstrate its incubation capabilities with new businesses accounting for a massive 50% of its EBITDA in FY23.

- Of the several projects underway, two of the key ones include the Navi Mumbai Airport and the Copper Smelter. Both are on schedule. The Navi Mumbai Airport is preparing for Operational Readiness and Airport Transition by Dec 2024

- The Integrated Resource Management volume increased by 37% to 88 MMT vs 64 MMT in FY 2021-22

- NDTV is expanding its international programming and coverage to serve a vast range of audiences across the globe.

- Our data centre JV AdaniConneX is on course to set up 350 MW capacity in the short term – and 1 GW capacity in the medium term. This is by far the largest order book in India. In combination with our strength in Green Power, this venture will be a game changer as computation becomes the most precious resource in the world.

Speaking of green power, the Adani Group is set to play a critical role in India’s net zero journey. Our renewable energy business, Adani Green Energy Limited, commissioned the world’s largest hybrid solar-wind project of 2.14 GW in Rajasthan.

- Our operational renewable energy portfolio has grown by 49% to over 8 GW. This is the largest operational renewable portfolio in India. Our focus remains on producing the lowest cost green electron at scale – and I would like to reaffirm our target of 45 GW of renewable energy capacity by 2030.

- And there is more! We are now building the largest hybrid renewables park in the world – right in the middle of the desert – in Khavda. It will be the most complex and ambitious project that we have ever executed. Spread over 72,000 acres, this project will be capable of generating 20 GW of green energy. And we intend to build it faster than any project in our execution history.

The ports business continued to be a pillar of strength on all fronts. APSEZ continues to be amongst the most profitable port operators globally with port EBITDA margin of 70% – and, by 2030, we intend to be not only the most profitable port company in the world but also India’s largest transport utility capable of handling a billion tonnes of cargo annually.

- By then, APSEZ will be carbon neutral and will also have tripled its EBIDTA.

- In the next 12-24 months, APSEZ will commission India’s largest transshipment hub in Vizhinjam, and also a port in a Colombo.

- And our acquisition of Haifa Port in Israel will allow us to link our ports all the way across the Indian Ocean to the Mediterranean, thereby positioning us to capitalize on both the India growth story and the much larger regional growth story.

Coming to Adani Power Limited, we successfully commissioned the 1.6 GW ultra-supercritical Godda power plant and are now supplying power to Bangladesh. This marks our entry into transnational power projects. Also, in the domestic power sector, APL is adding another 1.6 GW ultra-supercritical project in Mahan, Madhya Pradesh.

Adani Transmission Limited too is accelerating, with the transmission business continuing to grow faster than the market. ATL’s revenues are anticipated to expand by 18% and cross Rs 4,000 crore in annuity income. I am also very pleased to state that ATL’s Mumbai distribution business achieved reliability of 99.99% and was ranked the No.1 discom by the Union Ministry of Power. ATL will also take Mumbai to 60% renewable power making it the first mega city in the world to achieve over 50% power from solar & wind.

Adani Total Gas Limited expanded access to clean cooking fuel to 1,24,000 households this year with a 46% increase in revenue to Rs 4,683 crore. ATGL is transforming into a full spectrum sustainable energy provider with rapidly expanding urban EV charging infrastructure and biofuel businesses.

Finally, on the partnership front, the Adani Group continues to attract global investment partners aligned to our long-term approach of building and operating world-class assets. In March 2023, we successfully executed a secondary transaction with GQG partners of USD1.87 billion despite the volatile market conditions.

Never in the history of our Group have I been able to list so many achievements – and I continue to remain grateful for all your support and faith in us.

Dear Shareholders, Our country is now the most exciting land of opportunities. We have always expressed our belief in our growth with goodness philosophy and our track record speaks for itself. Your group will continue to consolidate what it has built while looking at expanding its horizons.

Our customers speak for us, our investors speak for us, our shareholders speak for us, and our results speak for us.

We could have chosen to settle for average growth numbers, or we could get up every day believing that we are on the cusp of being one of the most impactful conglomerates our nation has built.

44,000 Adanians made the latter choice.

Let me again reemphasize how grateful I am for all your support. It has been the source of my greatest strength. It is my promise that I will do my utmost to uphold the trust you put on me and my team.