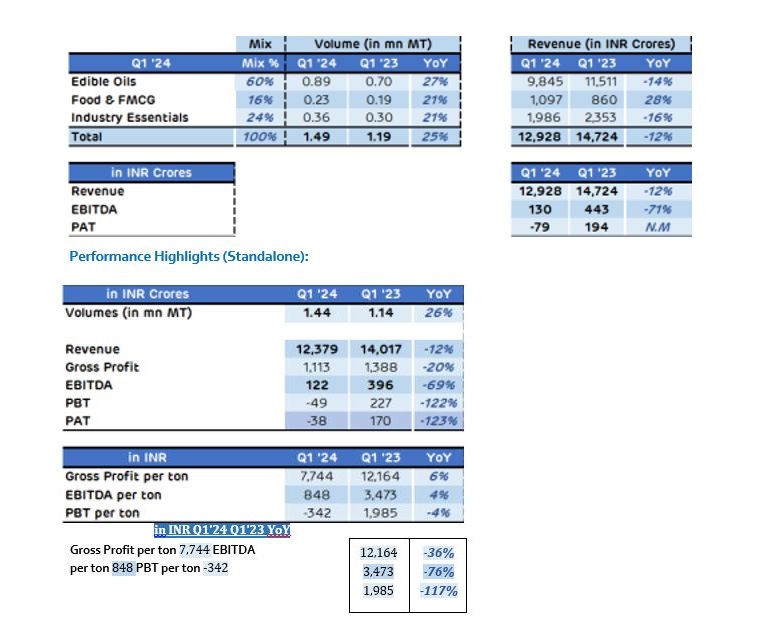

Adani Wilmar Limited (AWL) records 25% volume growth in Q1 ‘24, with broad-based growth across all segments

The Company delivered another strong quarter with 25% YoY volume growth, capturing the robust consumer demand. The sale of branded products in both edible oils and foods has been much stronger compared to overall sales of respective segments. While the volume growth was strong at 25% YoY, the sales value declined by 12% on YoY basis, which is reflective of the steep decline in edible oil prices.

The Food & FMCG segment recorded a strong revenue growth of 28% YoY to record close to INR 1,100 crores of revenue for the quarter.

Both urban and rural areas have witnessed strong demand. The oil and foods continued to grow at a rapid pace in the alternate channels (E-com, MT, eB2B etc.) and recorded around 50% YoY volume growth for the quarter. The Company kept its focus on expanding the distribution of both oil and food products in the General Trade channel. The sale of branded products to HoReCa clients continued to grow strongly with expansion of its distribution network in more cities and acquisition of new client accounts.

Over the time, the “King’s” brand has steadily built up a strong brand equity for edible oils in the masstige segment, delivering high-quality products to a large number of households. As a result, it has been the third-best selling brand of soyabean oil in India. The company is now strengthening the King’s brand and positioning it across its entire range of packaged oils and foods to gain market share from regional brands.

- Business Context

Since Q1 of the last fiscal year, the price of edible oils has been declining. This trend continued during Q1’24 with the price of edible oils experiencing further decline, in the range of 5% to 20% (Q1’24 vs Q4’23), before recovering as the quarter came to a close. This reduction has been attributed to a combination of factors, including the decline in consumer demand in developed economies, easing of supply at the Black Sea region and robust production of oilseeds globally.

- Performance Highlights (Consolidated):

- Reasons impacting Q1 profitability:

▪ Decline in edible oil prices continued in Q1 as well, leading to high-cost inventory. ▪ Hedges dis-alignment: Prices on commodity exchanges, which are used by Company to hedge price risk didn’t move in tandem with physical prices. As a result, hedges were in loss without corresponding gain in physical trade.

▪ TRQ disparity continued for this quarter as well.

▪ Finance cost: Interest expenses went up on YoY basis, with the increase in the benchmark rates on the back of hike in the Fed rates

▪ Bangladesh: Wholly owned subsidiary in Bangladesh made losses of ~INR 21 cr. in Q1, due to price caps by Government on edible oils, local currency-related issues, and unavailability of counter party for forex hedging. This has resulted in lower consolidated PAT, compared to the standalone PAT.

Commenting on the results, Mr. Angshu Mallick, MD & CEO, Adani Wilmar Limited said, “We have regained the momentum in our edible oil business with the decline in the edible oil prices. The soft prices of edible oil are expected to augur well for the industry. The company is gaining good share from regional brands in the under-indexed customer segments with marketing and sales focus on specific geographies and oil categories. To capture the opportunity in the value-added blended oils, Company is investing in this segment, under Xpert brand.

In Food & FMCG segment, this was the eighth consecutive quarter with 20%+ volume growth and 30%+ revenue growth, on YoY basis for the standalone Company.

Recognizing the pressing need of Indian households for genuine and consistent quality of whole wheat, the Company launched four premium grades (including Sharbati) of Whole Wheat under the Fortune brand in select markets. We developed a multi-purpose cleaner as a forward integration of our oleo-chemical products and launched this product under ‘Ozel’ band for HoReCa segment.

Our margins during the quarter got impacted by high-cost inventory in a falling edible oil price environment and dis-aligned hedges compared to spot prices of physical commodity.”

❖ Way Forward:

Distribution expansion, gaining share in under-indexed markets and margin improvement will be the key priorities going forward in the consumer pack segment in both Edible Oil and Food segments. The Company sees large opportunity in the HoReCa, institutional segment and exports as well and is working on plans to exploit these opportunities.