Cash profit of Rs. 2,929 Cr in FY21, up 45% YoY

PAT of Rs. 1,290 Cr in FY21, up 82% YoY

Cash profit of Rs. 639 Cr in Q4, up 51% YoY

PAT of Rs. 257 Cr in Q4, up 333% YoY

Operational Highlights FY21:

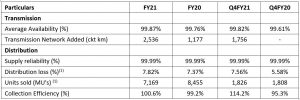

Transmission

- Robust Transmission system availability at 99.87%

Distribution

- Maintained supply reliability at 99.99% (ASAI)

- Collection efficiency in Distribution business was more than 100%

- Customer adoption of digital avenues increases manifold; e-payments as percentage of total collection increased to 67.2% in FY21 from 48.6% in FY20

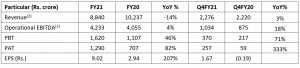

Financial Highlights FY21 (YoY):

- Cash Profit of Rs. 2,929 cr, up 45%

- PAT at Rs. 1,290 cr, up 82%

- EPS at Rs. 9.02 vs. Rs. 2.94 in FY20; up 207% YoY

- Consolidated Operational EBITDA at Rs. 4,233 cr vs. Rs. 4,055 cr in FY20, up 4%

- Transmission Operational EBITDA at Rs. 2,574 cr, up 4% with a margin of 92%

- Distribution Operational EBITDA at Rs. 1,659 cr, up 5%

Financial Highlights Q4 FY21 (YoY):

- Cash Profit of Rs. 639 cr, up 51%

- PAT at Rs. 257 cr, up 333%

- Consolidated Operational EBITDA at Rs. 1,034 cr vs. Rs. 875 cr in FY20, up 18%

- Transmission Operational EBITDA at Rs. 656 cr, up 6%

- Distribution Operational EBITDA at Rs. 377 cr, up 47%

Other Financial Highlights:

- With announcement of favorable regulatory order in respect of MEGPTCL in Q1 FY21, Consolidated EBITDA of ATL will have annual recurring benefit of Rs.60 cr.

Ahmedabad, May 6th, 2021: Adani Transmission Limited (“ATL”), the largest private transmission company in India, a part of globally diversified Adani Group today announced its financial and operational performance for year ended 31st March, 2021.

Operational Highlights:

- Added 2,536 ckt kms to transmission network in FY21 on account of organic and inorganic growth taking total network to 17,276 ckt kms

- Strong Transmission system availability at more than 99.87%

- Distribution business ensured more than 99.99% supply reliability despite challenges on ground

- Distribution losses were at 7.82% vs 7.37% in FY20

- Achieved more than 100% collection efficiency at AEML in FY21

Financial highlights – Transmission and Distribution:

- Stable Transmission business delivered operational revenue of Rs. 2,792 cr and operational EBITDA of Rs. 2,574 cr in FY21 translating into strong margin of 92%

- Distribution business operational EBITDA grew by 5% in FY21, in spite of 20% decline in operational revenue

Financial Highlights – Consolidated:

- Consolidated operational revenue was lower at Rs. 8,840 Cr in FY21 mainly due to lower revenue contribution from Distribution business led by lower power consumption in Commercial and Industrial segment in first half of FY21. However, operational revenue from Transmission business was unaffected in FY21.

Other Key Highlights:

- ATL acquired Warora-Kurnool Transmission Limited (WKTL) owned by Essel InfraProjects Limited adding 1,750 ckt kms to its total transmission network of 17,276 ckt kms

- Customer adoption of digital avenues to interface with company increases manifold reaching 67.2% (e-payments as a % of total collection) in FY21 from 48.6% in FY20

- With the amendment in electricity act, the Distribution sector to offer tremendous growth opportunities

Notes:

(1) Distribution loss and units sold are slightly different from provisional operational data released on 20th April 2021

(2) FY21 Operational Revenue and Operational EBITDA doesn’t include one-time positive impact of Rs. 330 Cr. from APTEL order in favor of MEGPTCL SPV of Transmission business. Based on MERC order, the company has recognised one-time revenue of Rs. 254 Crs in FY20 which doesn’t include in FY20 Operational revenue and Operational EBITDA (Rs. 110 Cr one-time revenue pertaining to transmission business and Rs. 144 Crs of revenue gap pertaining to Distribution business). (3) Cash profit calculated as PAT + Depreciation + Deferred Tax + MTM option loss; ASAI: Average Service Availability Index; APTEL: Appellate Tribunal for Electricity

Speaking on the performance of the company, Mr. Gautam Adani, Chairman Adani Group, said, The Power & Transmission sector has seen tremendous progress over the last two decades. Today, Government initiatives such as Saubhagya and the emphasis on renewables have significantly expanded electricity access. The next two decades promises to usher in new opportunities for the sector based on the resurgence of the economy post the pandemic and a positive investor outlook. ATL is fully equipped to co-create a future in line with the needs of a nation at the cusp of global renewable energy leadership”

Mr. Anil Sardana, MD & CEO, Adani Transmission Ltd, said, “Adani Transmission has evolved over the past few years. ATL’s two acquisitions (APTL and WKTL) during the year will bolster its pan-India presence, consolidating further its position as the largest private sector transmission company in India and moving it closer to its goal of 20,000 ckt km of transmission lines by 2022. ATL is constantly benchmarking to be the best-in-class and is pursuing focused approach to be world-class integrated utility through development agenda coupled with de-risking of strategic and operational aspects, capital conservation, ensuring high credit quality and forging strategic partnerships for business excellence and high governance standards. ATL is maintaining 24×7 quality power supply despite challenges posed by health and pandemic issues. The journey towards robust ESG framework and practicing culture of safety is integral to its pursuit for enhanced long-term value creation for all stakeholders”

About Adani Transmission Limited

Adani Transmission Limited (ATL) is the transmission and distribution business arm of the Adani Group, one of India’s largest business conglomerates. ATL is the country’s largest private transmission company with a cumulative transmission network of ~17,200 ckt km, out of which ~12,350 ckt km is operational and ~4,850 ckt km is at various stages of construction. ATL also operates a distribution business serving about 3 million+ customers in Mumbai. With India’s energy requirement set to quadruple in coming years, ATL is fully geared to create a strong and reliable power transmission network and work actively towards serving retail customers and achieving ‘Power for All’ by 2022.

(Sanket Mehta)