Virendra Pandit

New Delhi: On Wednesday, the USA subtly pushed Russia closer to the brink of a historic debt default by not extending its license to pay bondholders, as Washington ramped up pressure following Russia’s invasion of Ukraine.

On its website, the US Treasury Department said it would let lapse a license that expired at 12:01 AM ET (0401 GMT) on Wednesday and allowed Russia to make interest and maturity payments on its sovereign debt to the American persons.

That Russia is feeling the sting of sanctions surfaced when a bondholder said he had not received payment due on Friday last. Another Asia-based bondholder said the payment had not arrived in the firm’s account by Wednesday. Russia still had a 30-day grace period on the two payments, and may yet pay it up.

Russia has to make a USD 2 billion payment until December-end as its finance ministry insisted it will service debt in its national currency, the ruble.

Although the waiver has allowed Russia to keep up government debt payments, its expiry now appears to make default inevitable on at least some of its USD 40 billion worth of international bonds – Russia’s first major external one for more than a century.

Western sanctions imposed after the Kremlin’s February 24 invasion of Ukraine, and countermeasures from Moscow, have complicated the movement of money across borders. Russia has attempted to keep paying bondholders. But with almost USD 2 billion worth of payments falling due before year-end, it may soon run out of the road, the media reported.

On Friday last, Russia had rushed payments on two international bonds – one denominated in euros and the other in dollars – a week before their due date.

Moscow’s National Settlement Depository (NSD), where the bonds with interest due May 27 get settled, said it had received the hard currency needed to make the payment and would do so on Friday.

Russia’s finance ministry said on Wednesday it had the cash and willingness to pay, and that Moscow will service its external debt in roubles, which can be converted later into the currency of the original Eurobonds. The ministry said the US decision not to extend a waiver allowing Russia to service its bonds in foreign currencies would hit foreign investors first.

But bonds are not the only flash point as the financial tit-for-tat ratchets up.

The West-led sanctions imposed on Russia for launching the largest land war in Europe since the Second World War include freezing roughly half of its USD 640 billion worth of foreign currency reserves.

The European Union might agree on an embargo on Russian oil imports “within days” according to Germany.

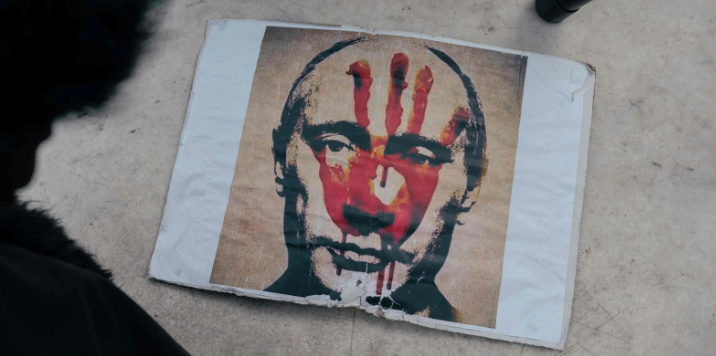

Moscow claims it’s nearly three-month-old invasion is a “special military operation” to rid Ukraine of fascists, an assertion Kyiv and its Western allies say is a baseless pretext for an unprovoked war that has remained inconclusive so far.

Earlier, credit rating agencies had rated Russia as investment-grade. Since the Ukraine conflict, they have stopped assessing the country, and it is effectively shut out of international capital markets.

Any default would prevent Russia from regaining access until creditors are fully repaid and they settle any legal cases stemming from the default.

Previous debt defaults, such as by Argentina, prompted creditors to go after physical assets such as a navy vessel and the country’s presidential aircraft.