Retail, wholesale trading as MSMEs: 2.5 cr traders can now take bank loans

Virendra Pandit

New Delhi: With the Centre deciding to include retail and wholesale traders’ businesses under the Micro, Small, and Medium Enterprises (MSMEs), nearly 2.5 crore traders across India can now register on the Udyam Registration Portal and be able to avail bank loans.

With this new classification, these traders will be able to avail finances from banks and financial institutions under priority sector lending as per the guidelines of the Reserve Bank of India (RBI), media reported on Friday.

For more than a year, retailers and wholesale traders had been demanding the inclusion of their activity under the MSMEs.

Union Minister of MSMEs and Road Transport and Highways Nitin Gadkari on Friday said that the government has released revised guidelines with the inclusion of retail and wholesale traders as MSMEs.

“Retail and wholesale trade were left out of the ambit of MSME. Under the revised guidelines, the Ministry of MSMEs has issued the order to include retail and wholesale trade as MSMEs and extending to them the benefit of priority sector lending under the RBI’s guidelines,” he said. This would benefit 2.5 crore retail and wholesale traders, and they will now be able to register on Udyam Registration Portal.

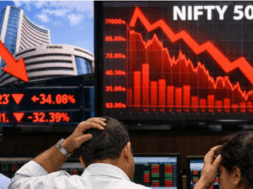

The Covid-19 pandemic had put retail and wholesale traders under tremendous financial stress as they faced a liquidity crunch.

According to a survey by the Retailers Association of India (RAI), the retail sector, which small traders dominate, saw a 79 percent contraction in monthly sales in May this year compared to pre-Covid levels in May 2019, due to lockdown-like restrictions imposed by state governments to curb the second pandemic wave.

RAI’s CEO Kumar Rajagopalan welcomed the new decision saying it will have a structural impact on the sector and help it get formalized by giving better finance options for businesses that want to get structured. It will give retail MSMEs the support they need to survive, revive and thrive.

Praveen Khandelwal, Secretary-General, Confederation of All India Traders (CAIT), said that the pandemic-affected traders will now be able to restore their businesses by obtaining necessary finances from the banks which were earlier denied to them. This will be an important step in reviving not only the economy but also the retail sector.

Besides, the traders will also be eligible for several other benefits under other government schemes after their businesses’ inclusion in the MSME category.

On June 28, the Finance Ministry announced to increase the emergency credit line guarantee scheme (ECLGS) from Rs.3 lakh crore to Rs. 4.5 lakh, which is expected to benefit the MSME sector.