Virendra Pandit

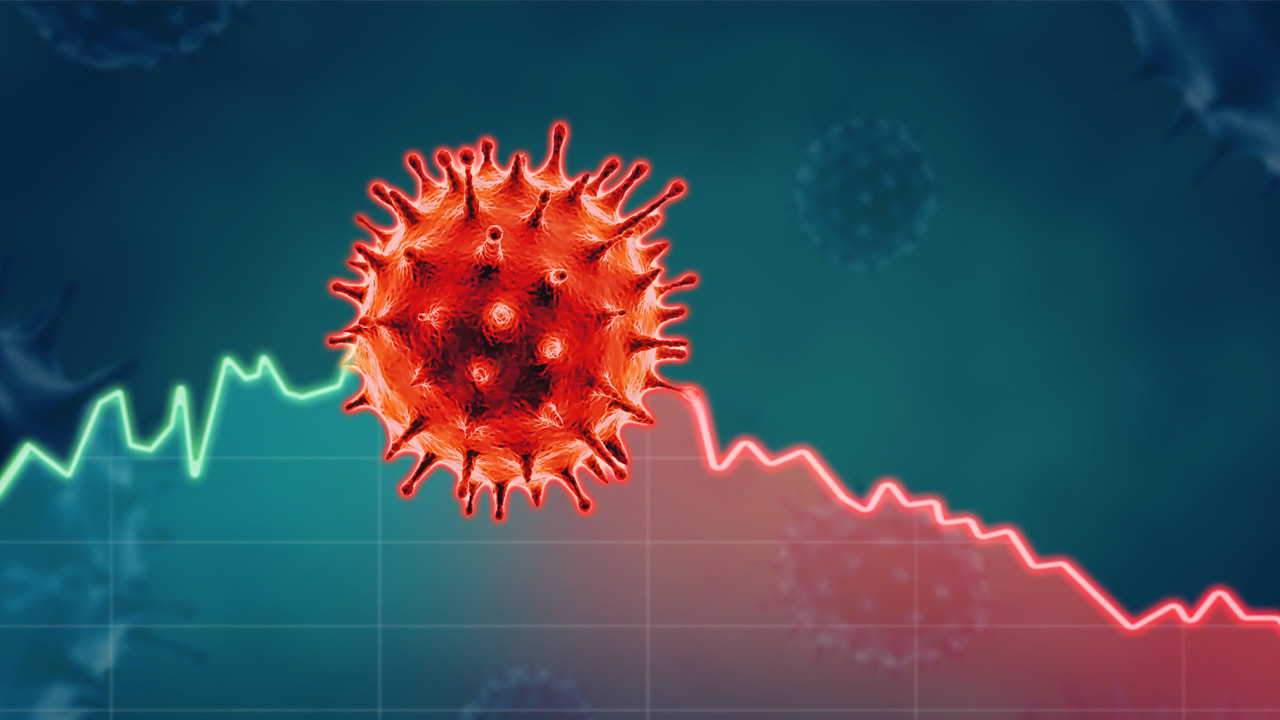

New Delhi: The Union Finance Ministry on Friday said the second wave of Covid-19 has posed a downside risk to economic activity in the first quarter of 2021-22 (April-June 2021) but its impact is expected to be muted on the Indian economy unlike the first wave’s in 2020.

In its monthly economic review for April, the ministry’s Department of Economic Affairs (DEA) said “the second wave in India is witnessing a much higher caseload with new peaks of daily cases, daily deaths, and positivity rates and presents a challenge to ongoing economic recovery.

“With infections forcing localized or state-wide restrictions, there is a downside risk to growth in the first quarter of FY22. However, there are reasons to expect a muted economic impact as compared to the first wave. The experience from other countries suggests a lower correlation between falling mobility and growth as economic activity has learned to operate ‘with Covid-19,” the report said.

Due to the pandemic’s resurgence in April, the momentum gained in economic recovery since the first wave moderated. However, agriculture continues to be the silver lining with record food-grain production estimated in the ensuing crop year on the back of predicted normal monsoons.

The Wholesale Price Index (WPI) inflation increased to an 8-year high of 7.39 percent, led by oil and metal prices as well as base-effect, exceeding its CPI counterpart after nearly 2 years. Softening food and fuel prices, with a normal monsoon and expected supply easing of food products, may provide succor to a potent risk of rising in input prices surfacing as retail inflation, the report said.

The pandemic also hit the market sentiment as Nifty 50 and the S&P BSE Sensex recorded losses of 0.4 percent and 1.5 percent, respectively, in April, and the rupee depreciated by 2.3 percent to reach Rs 74.51 to a dollar. This was mirrored by net FPI outflows of USD 1.18 billion in April.

Domestic financial conditions, nevertheless, continue to remain comfortable with RBI’s support to liquidity, with open market operations worth Rs 3.17 trillion carried out in FY21.

On the external front, India’s trade deficit hit its lowest in FY21 since FY08, with a stronger contraction in imports compared to that of exports. While drugs and pharma were the frontrunners in exports, safe-haven gold led the imports trajectory.

On the mutated contagious strains, which have hit again in 2021 with a rapid resurgence in global cases, notably in India, the ministry said that rapid vaccination lends a ray of hope.

“April 2021 saw a doubling of global vaccination rates and a concomitant lowering of average transmission rates in countries with high vaccination rates. With vaccines doubly effective in battling the spread and shielding the economy, global co-operation is critical to ensuring availability of vaccines in all countries and addressing inter-country disparities in vaccination rates at the earliest,” it said.

About the fiscal position, the report said the central government has witnessed improvement in the recent months with a revival in the economic activities during the second half of FY21. As per provisional figures, net direct tax collections for FY21 are 4.5 percent higher than Revised Estimates (RE) and 5 percent higher than collections in FY20. Net indirect tax collections for FY21 were 8.2 percent higher than the RE and 12.3 percent over collections in FY20.