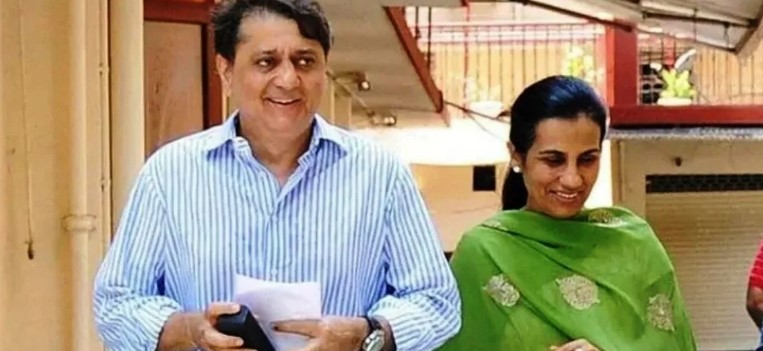

New Delhi: A special court in Mumbai on Saturday remanded ICICI Bank’s former CEO and MD Chanda Kochar and her husband Deepak Kochhar in the custody of the Central Bureau of Investigation (CBI) until December 26 in connection with alleged cheating and irregularities in loans sanctioned by the bank to Videocon Group companies.

The CBI, which had called the couple to New Delhi on Friday for a brief questioning session, found them evasive in their responses and later arrested them.

Chanda Kochhar, 61, had taken over as the ICICI Bank’s MD and CEO on May 1, 2009, and quit in October 2018 over allegations that she favored Videocon Group, a consumer electronics and oil and gas exploration company.

On Saturday morning, a CBI team accompanied the Kochhars on a flight to Mumbai.

The CBI had named the Kochhars and Dhoot, along with companies Nupower Renewables (NRL) managed by Deepak Kochhar, Supreme Energy, Videocon International Electronics Ltd, and Videocon Industries Limited, as accused in the FIR registered under IPC sections related to criminal conspiracy and provisions of the Prevention of Corruption Act in 2019.

The ICICI Bank had sanctioned credit facilities to the tune of Rs 3,250 crore to the companies of Videocon Group promoted by Dhoot in alleged violation of the Banking Regulation Act, RBI guidelines, and credit policy of the bank.

As a part of the quid pro quo, Dhoot invested Rs 64 crore in Nupower Renewables through Supreme Energy Pvt Ltd (SEPL) and transferred SEPL to Pinnacle Energy Trust managed by Deepak Kochhar through a circuitous route between 2010 and 2012, officials said.

During Chanda Kochhar’s tenure at ICICI Bank, six loans worth Rs 1,875 crore were cleared for the Videocon Group and its associated companies during 2009-11.

She was on the sanctioning committees to decide on two loans — Rs 300 crore to Videocon International Electronics Limited (VIEL) on August 26, 2009, and Rs 750 crore to Videocon Industries Limited on October 31, 2011.

They issued the loans in alleged violation of the laid-down policies and regulations of the bank. Most of these loans became non-performing assets, causing a loss of Rs 1,730 crore to the bank, it alleged.

A day after ICICI Bank disbursed the Rs 300-crore loan to VIEL, Dhoot transferred Rs 64 crore to Nupower Renewables, on September 8, 2009, from Videocon Industries Ltd through SEPL.

“This was the first major capital received by NRL (Nupower Renewables) to acquire the first power plant. Chanda Kochhar got illegal gratification, undue benefit through her husband from VIL/VN Dhoot for sanctioning Rs 300 crore loan to VIEL,” the FIR alleged.